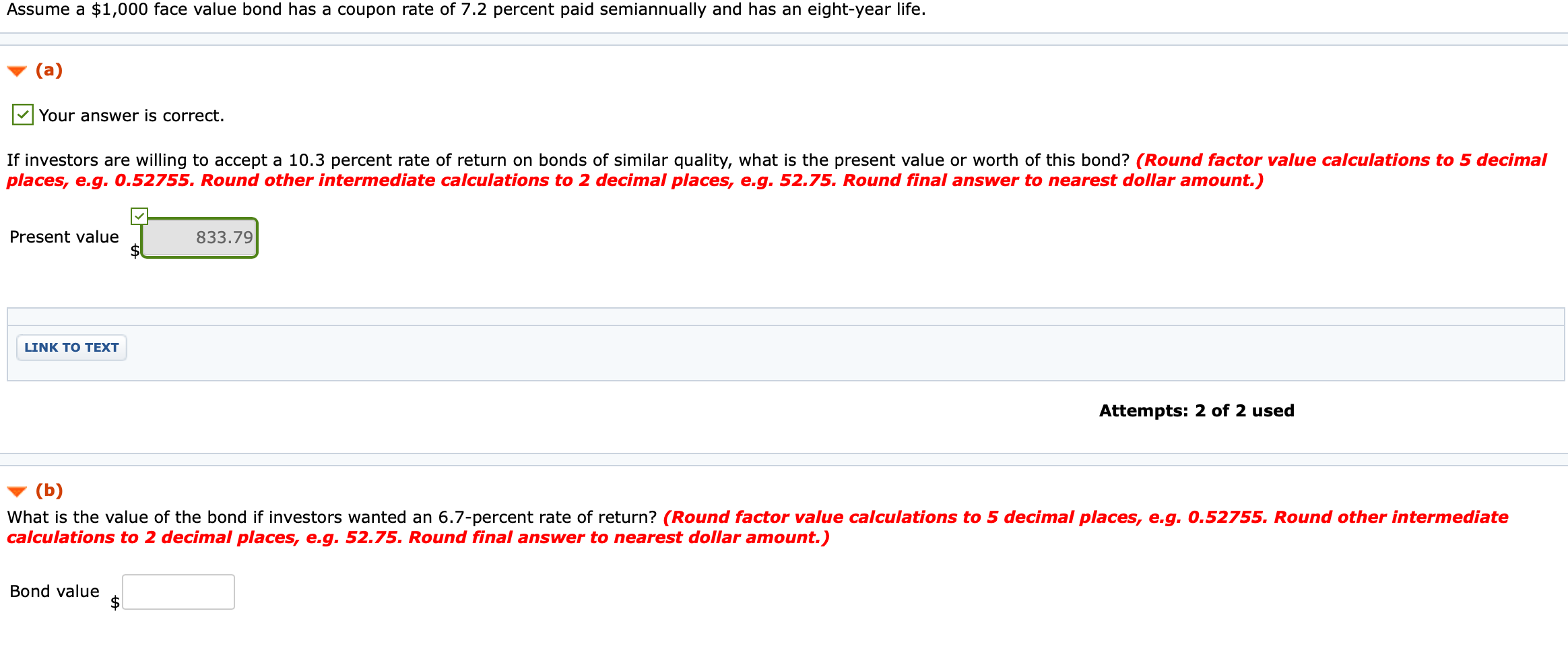

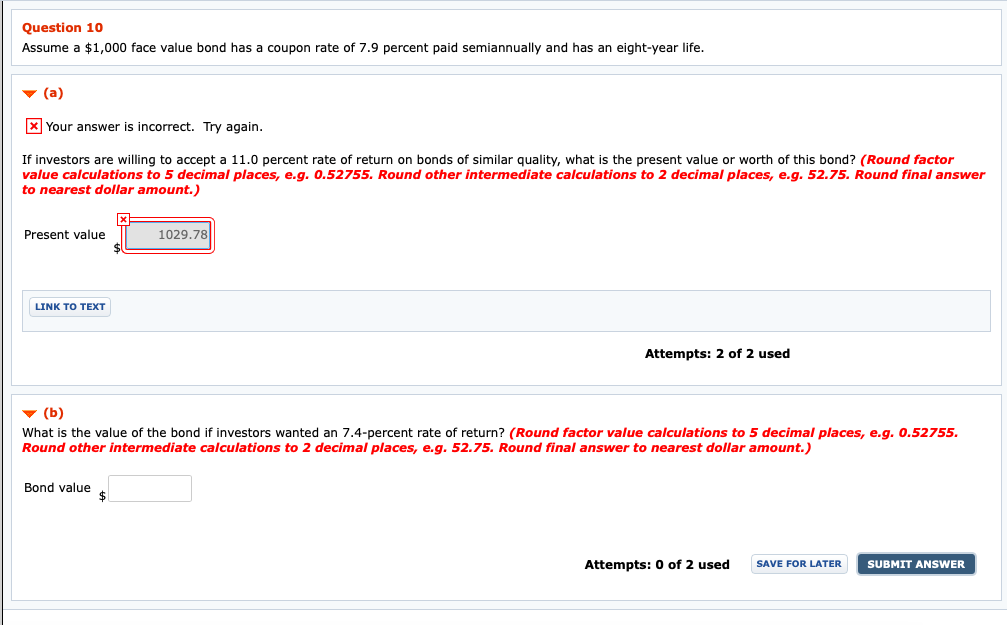

39 coupon value of a bond

Zero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.

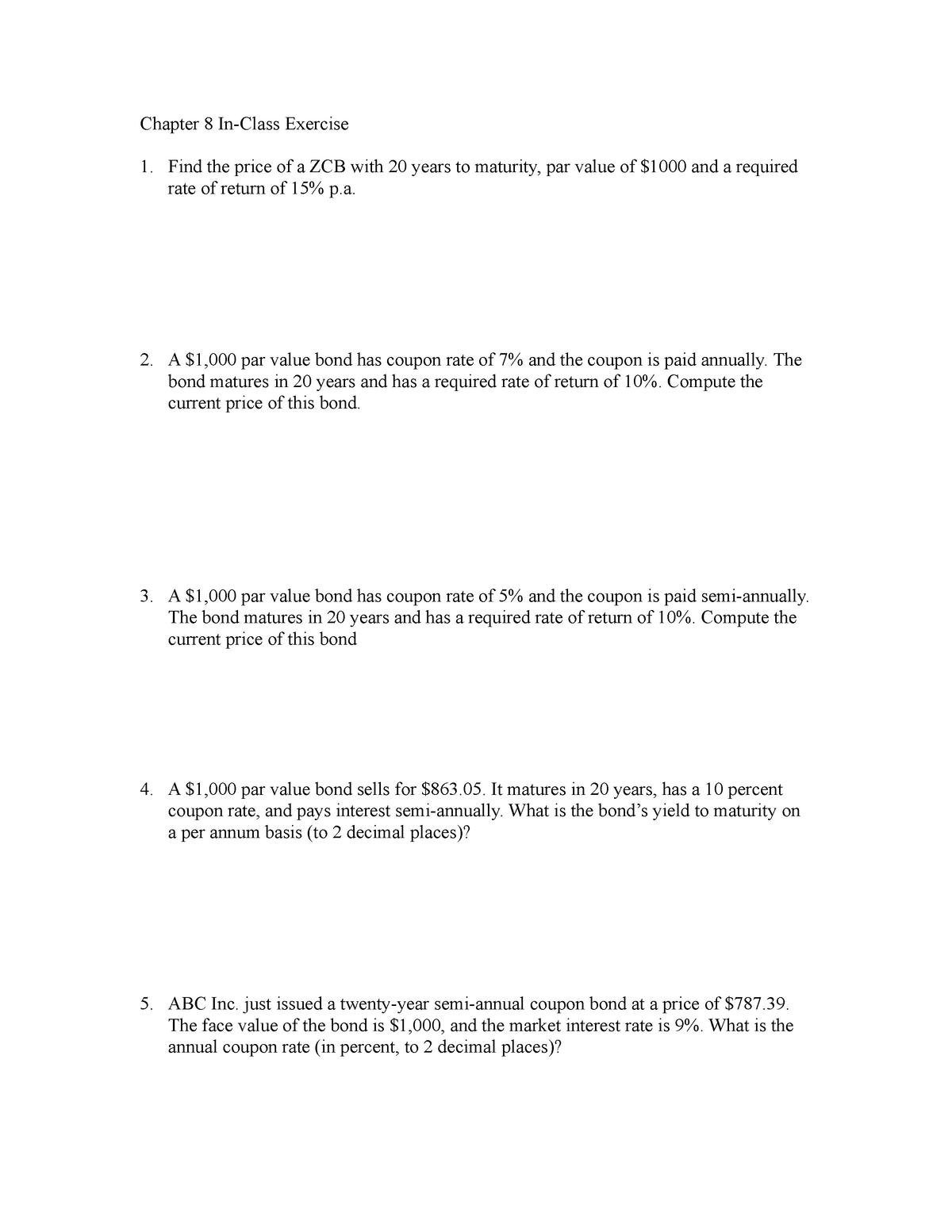

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Years to Maturity - The number of years remaining until the bond pays out the face value. You may use decimals here - 9 years and 6 months is 9.5 years, for example. Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency ...

Coupon value of a bond

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... What Is a Bond Coupon? - The Balance 04.03.2021 · The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest payments. Zero-coupon bonds don't pay interest. They instead mature to a value greater than the principal investment. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury …

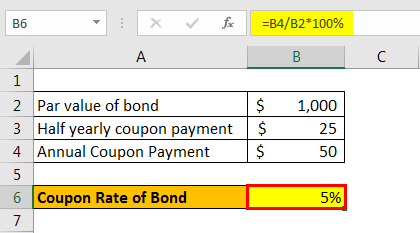

Coupon value of a bond. Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Bond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ... Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 – (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps: Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury …

What Is a Bond Coupon? - The Balance 04.03.2021 · The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest payments. Zero-coupon bonds don't pay interest. They instead mature to a value greater than the principal investment. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

:max_bytes(150000):strip_icc()/manlookingatcomputer-2368f094bfc7428b8e7b86e34186139d.jpeg)

Post a Comment for "39 coupon value of a bond"