39 zero coupon bond investopedia

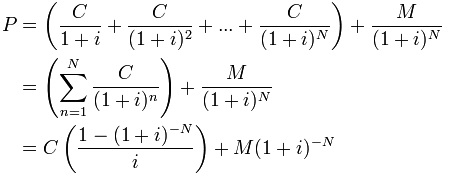

zero coupon - Are pure PIK bonds' payoffs known from the start ... - Investopedia. Therefore, for these bonds to have a reason to exist, I would expect Y to not be known from the start. Is that the case, and if it is : what actually happens when a "coupon" is paid ? If additional bonds issued by the PIK bond issuer are used to pay, does the bond yield depend on the current yield investors ask of this company ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.

Zero coupon bond investopedia

Investopedia Video: Zero-Coupon Bond - YouTube Investopedia 218K subscribers Subscribe A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full... The Dummies Guide To Zero Coupon Bonds - ED Times Let's look at the very basic, super simple Zero-Coupon Bonds. Zero coupon bonds are probably the simplest financial assets or bonds to value since they only have one cash flow. As the name implies, zero coupon bonds do not have any coupon payments attached with them. The only cash flow for zero-coupon bonds is the face value at maturity. What is a Zero-Coupon Bond? - Realonomics A 'zero coupon bond' is a fixed interest security that does not pay a coupon, instead it is sold at a discount so that on maturity, the investor receives the full face value with the profit being the difference between the discounted purchase price and the redemption price at face value. Are treasury STRIPS a good investment?

Zero coupon bond investopedia. What are Zero coupon bonds? - INSIGHTSIAS These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par. What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank. Zero-Coupon Bond - The Investors Book Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself. Special Zero Coupon Recapitalisation Bonds - Drishti IAS Why in News. Recently, the government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the bank Rs. 5,500 crore worth Special Zero Coupon Recapitalisation Bonds.. Punjab & Sind Bank is a Government of India undertaking.; Key Points. Bank Recapitalisation: It means infusing more capital in state-run banks so that they meet the capital adequacy norms. Zero Coupon Bond Yield: Formula, Considerations, and ... - Investopedia Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged...

How are zero-coupon bonds issued? - Quantitative Finance Stack Exchange Here is a brief reference at Investopedia. A zero-coupon bond, also known as an "accrual bond," is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. Share Improve this answer Follow answered Mar 28, 2017 at 15:55 What is a Zero-Coupon Bond? - Realonomics A 'zero coupon bond' is a fixed interest security that does not pay a coupon, instead it is sold at a discount so that on maturity, the investor receives the full face value with the profit being the difference between the discounted purchase price and the redemption price at face value. Are treasury STRIPS a good investment? Zero coupon bonds - Chrome IAS A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. A zero-coupon bond is also known as an accrual bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor ... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero-coupon bond - Bogleheads Zero-coupon bonds or "zeros" result from the separation of coupons from the body of a security. Consequently, from a single coupon-paying bond, two bonds result: one which pays the coupons but returns no principal at maturity (an annuity), and one which pays no coupons but returns the par value at maturity (a zero-coupon bond). Zero Coupon Bond Yield: Formula, Considerations, and Calculation EssentialsTechnical AnalysisRisk ManagementNewsCompany NewsMarkets NewsCryptocurrency NewsPersonal Finance NewsEconomic NewsGovernment NewsSimulatorYour MoneyPersonal FinanceWealth ManagementBudgeting SavingBankingCredit CardsHome OwnershipRetirement PlanningTaxesInsuranceReviews RatingsBest Online BrokersBest Savings AccountsBest Home WarrantiesBest Credit CardsBest Personal LoansBest Student ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent... Bootstrapping (finance) - Wikipedia In finance, bootstrapping is a method for constructing a (zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps.. A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve.

Zero-Coupon Bonds and Taxes - Investopedia A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so...

All About Zero Coupon Bonds - Yahoo! Zero-coupon bonds are bonds that do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity. For investors, this means that if you make an...

What Is a Zero Coupon Yield Curve? - Smart Capital Mind A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond.

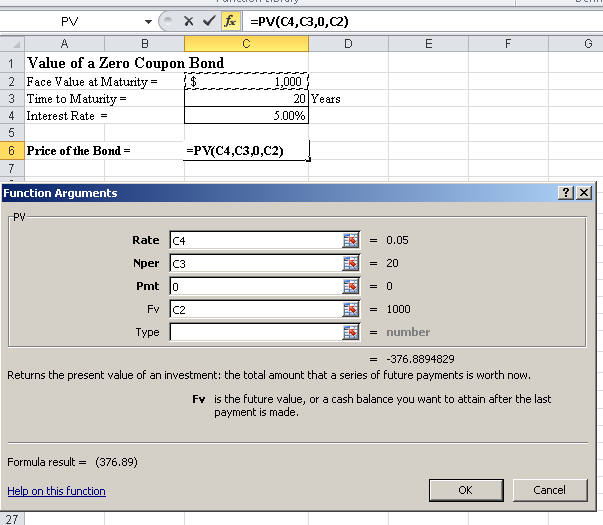

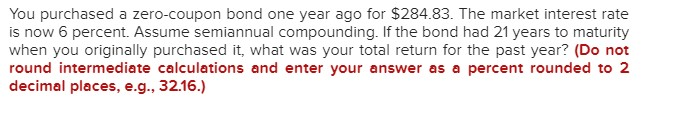

How to Calculate the Price of a Zero Coupon Bond First, divide 6 percent by 100 to get 0.06. Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

OECD Glossary of Statistical Terms - Zero-coupon / deep discount bond ... Definition: A zero-coupon/deep discount bond is a debt security with no coupon (zero-coupon) or substantially lower coupon than current interest rates. The bonds are issued at a discount to their nominal value, with the discount reflecting the prevailing market interest rate.

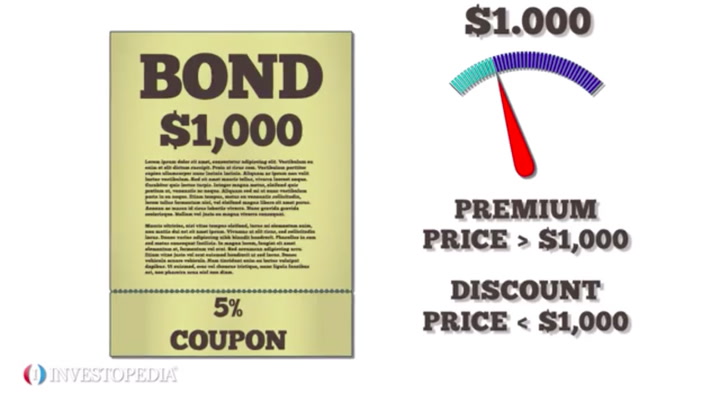

What does it mean if a bond has a zero coupon rate? - Investopedia A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A bond that sells for...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) Čo je to dlhopis s nulovým kupónom. Dlhopis s nulovým kupónom je dlhový cenný papier, ktorý neplatí úroky, ale namiesto toho obchoduje s hlbokou zľavou, ktorá vytvára zisk pri splatnosti, keď je dlhopis splatený za celú nominálnu hodnotu.1

What is a Zero-Coupon Bond? - Realonomics A 'zero coupon bond' is a fixed interest security that does not pay a coupon, instead it is sold at a discount so that on maturity, the investor receives the full face value with the profit being the difference between the discounted purchase price and the redemption price at face value. Are treasury STRIPS a good investment?

The Dummies Guide To Zero Coupon Bonds - ED Times Let's look at the very basic, super simple Zero-Coupon Bonds. Zero coupon bonds are probably the simplest financial assets or bonds to value since they only have one cash flow. As the name implies, zero coupon bonds do not have any coupon payments attached with them. The only cash flow for zero-coupon bonds is the face value at maturity.

Investopedia Video: Zero-Coupon Bond - YouTube Investopedia 218K subscribers Subscribe A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full...

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

/CoupleDiscussingFinances-b8a973ead5384d31af51e8e65ec595ed.jpg)

Post a Comment for "39 zero coupon bond investopedia"