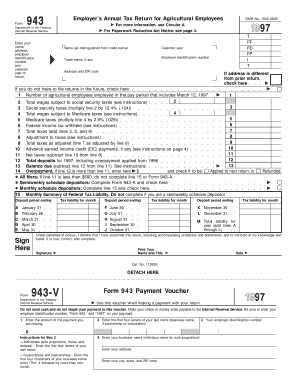

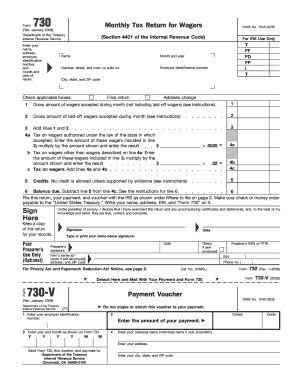

39 irs quarterly payment coupon

IRS Mailing Address: Where to Mail IRS Payments File Here is a clear guide on how to fill in IRS Form 1040 using PDFelement. Step 1. Import IRS Form 1040 into PDFelement You need to launch PDFelement on your device and access "Open Files" to import Form 1040 for filling it out across the platform. Try It Free Step 2. Fill Out Appropriate Fields of Irs Form 1040 7 Ways To Send Payments to the IRS There are 7 easy ways to send payments to the IRS. The IRS typically announces the date when it will begin accepting tax returns during the first week of January of each year. You can pay the IRS in several ways when the time comes: in person at various payment centers, online, or by mailing a check or money order through the U.S. Postal Service.

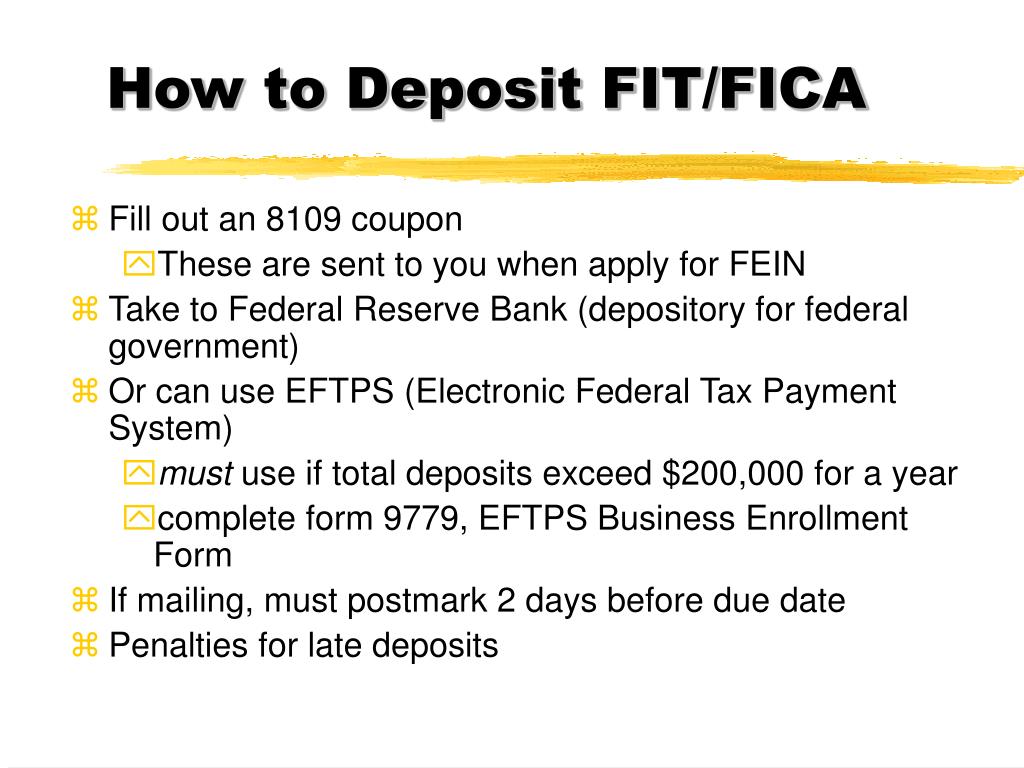

help.taxreliefcenter.org › 941-late-payment-penaltyFailure To Deposit: IRS 941 Late Payment Penalties | Tax ... Sep 10, 2019 · 10% of the amount deposited within 10 days of receipt of an IRS request for payment notice; 15% of the amount not deposited within 10 days of IRS demand for payment receipt; 100% of the un-deposited amount for deliberate remittance negligence (Trust Fund Recovery Recovery Penalty) The IRS expects deposits via electronic funds transfer.

Irs quarterly payment coupon

Quarterly Estimated Tax Payments - Who Needs to pay, When And Why If you pay by credit card, the IRS will refer you to an approved payment system. There will be a fee for using this method. It can range from a flat fee of $2.59 per payment to up to 2% of the amount paid. It will add to the outlay of the estimates, so it's best to pay through your bank if you can. Form 1040-ES Do I need to make estimated tax payments to the IRS? - Intuit If taxes aren't withheld from the income you receive, making quarterly estimated tax payments can help you avoid paying a big tax bill or an underpayment penalty in April. You're Self-Employed. When you're self-employed, federal, state, and Social Security taxes aren't taken out of the income you receive. download.eftps.com › PaymentInstructionBookletPayment Instruction Booklet - EFTPS Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 940 940 12 Employer’s Quarterly Federal Tax Return Payment due with a return Payment due on an IRS notice 09405 09401 09404 941 941 03, 06, 09, 12 Employer’s ...

Irs quarterly payment coupon. Payments | Internal Revenue Service - IRS tax forms 28/05/2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Where to File Addresses for Taxpayers and Tax Professionals Filing Form ... Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation ... CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. ... Internal Revenue Service P.O. Box 1303 Charlotte, NC ... DOR Estimated Tax Payments | Mass.gov Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. It's fast, easy, and secure. In addition, extension, return, and bill payments can also be made. Calculations. Before making an Income quarterly estimated payment, calculate online with the Quarterly Estimated Tax Calculator. Generating estimated tax vouchers for an 1120 Corporation Forms 8109 and 8109-B, Federal Tax Coupon, can no longer be used to make federal tax deposits. Generally, electronic funds transfers are made using the Electronic Federal Tax Payment System (EFTPS). ... Each quarterly estimated tax payment must be e-filed separately and in the order of the quarterly payments. Only a single payment will be ...

If You Have a Side Hustle, Your Estimated Taxes Are Due Today It's important to pay quarterly estimated taxes to avoid tax penalties -- and a huge tax bill -- when filing your tax return. What's next. The next estimated tax due date is June 15, 2022. Where To Mail Quarterly Tax Payments? (Best solution) The following group of people should mail their Form 1040- E.S. to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201- 1300 USA. To make your estimated quarterly tax payments by mail, tear off the voucher at the bottom of Form 1040-ES and mail it to the IRS. Include a check or money order for your payment. How To Get Ahead on Tax Payments for Next Year - The Balance Estimated tax payments are quarterly payments individuals can make to the IRS to help pay their taxes throughout the year. ... You can mail your estimated tax payments by first completing a voucher and then mailing a check or money order to one of three addresses, depending on where you live. If you live in Alabama, Florida, Georgia, Louisiana ... 2022 Form 1040-ES - IRS tax forms 1st payment..... April 18, 2022 2nd payment..... June 15, 2022 3rd payment..... Sept. 15, 2022 4th payment..... Jan. 17, 2023* * You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return. If you mail your payment and it is postmarked by the

How do I make estimated tax payments? - Intuit Mail your payment along with the corresponding 1040-ES voucher to the IRS address listed on the voucher. Quarterly payment due dates are printed on each voucher. Additional estimated tax payment options, including direct debit, credit card, cash, and wire transfer, are available at the IRS Payment website. IRS: Deadline for third quarter estimated tax payments is Sept. 15 IR-2021-177, September 7, 2021. WASHINGTON — The Internal Revenue Service reminds people that September 15, 2021, is the deadline for third quarter estimated tax payments. This generally applies to people who are self-employed and some investors, retirees and those who may not normally have taxes withheld from their paycheck by their employers. Quarterly Estimated Tax Payments - Who Needs to pay, When … 30/05/2022 · You can even have the over-payment equally distributed across all four estimates. A $4,000 over-payment can be used to reduce each of the four payments by $1,000. How to pay quarterly taxes Divide your tax liability by four. Quarterly estimated tax payments are usually determined when you file your tax return for the previous year. Generally ... Montana Individual Income Tax Payment Voucher (Form IT) Montana Individual Income Tax Payment Voucher (Form IT) 2021: 30-12-2021 11:47: Download: Available in our TransAction Portal (TAP)?mdocs-file=55943. Contact Customer Service ... You can request a payment plan for making tax payments through TAP. Requesting a payment plan requires you to be logged in. Learn more about Requesting a payment plan.

What taxpayers need to know about making 2021 estimated tax payments Here are some details about estimated tax payments: Generally, taxpayers need to make estimated tax payments if they expect to owe $1,000 or more when they file their 2021 tax return, after adjusting for any withholding. The IRS urges anyone in this situation to check their withholding using the Tax Withholding Estimator on IRS.gov.

What Happens If You Miss a Quarterly Estimated Tax Payment? What to do if you skipped an estimated tax payment. The IRS expects you to pay by the deadline. If you miss one, make the quarterly tax payment as soon as you can. Some people might think, “Well, I already missed this quarterly payment. I’ll just wait until next quarter to make it up.” Unfortunately, that's a big mistake. Why? Because the ...

Individual Estimated Tax Payment Form - AZDOR Individual Estimated Tax Payment Form. Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment; a partnership or S corporation mailing a voluntary estimated payment on behalf of its nonresident individual partners/shareholders participating in the filing of a composite return.

IRS Notice 433: Interest and Penalty Information - Investopedia IRS Notice 433 - Interest and Penalty Information: A document published by the Internal Revenue Service that outlines the interest rate applied to overpaid or underpaid taxes, as well as the ...

Form 1040-V: Payment Voucher Definition - Investopedia Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. 1 ...

2021 QUARTERLY ESTIMATED TAX DUE DATES TO THE IRS … 16/12/2020 · If you mail your estimated tax payment and the date of the U.S. postmark is on or before the due date, the IRS will generally consider the payment to be on time. If you use IRS Direct Pay, you can make payments up to 8 p.m. Eastern time on the due date. If you use a credit or a debit card, you can make payments up to midnight on the due date ...

› payPayments | Internal Revenue Service May 28, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

› posts › what-happens-if-you-missWhat Happens If You Miss a Quarterly Estimated Tax Payment? Mar 21, 2022 · The problem is, not everyone knows about these quarterly taxes. And even if they're on your radar, it can be easy to skip a deadline. Never fear. In this article, we'll go over everything you need to know about missing a quarterly estimated tax payment — including what the penalties are and how to potentially get out of them.

Form 1040-ES: Paying Estimated Taxes - Jackson Hewitt Form 1040-ES is used to calculate and pay your quarterly estimated tax payments. This form can be manually completed and filed quarterly during the year. Form 1040-ES can be generated by tax software. Once your estimated tax payment has been calculated, the current payment voucher must be sent to the correct IRS address based on the state where ...

How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ...

Failure To Deposit: IRS 941 Late Payment Penalties 10/09/2019 · Businesses file Employer's Quarterly Federal Tax Return paid after a month of each quarter. Here's what you need to know about 941 late payment penalty. Businesses file Employer's Quarterly Federal Tax Return paid after a month of each quarter. Here's what you need to know about 941 late payment penalty. Our mission is to protect the rights of …

How do I print estimated tax vouchers for my 2022 taxes? You can print next year's estimated tax vouchers (Form 1040-ES) in your 2021 program: Sign in to your TurboTax account, then open your return by selecting Continue or Pick up where you left off in the progress tracker; When your return is open, search for 1040-es (be sure to include the dash) and select the Jump to link in the search results; Answer No to the question Do you want to change ...

How to set up a payment plan with IRS - ConsumerAffairs 01/04/2022 · IRS payment plan fees are waived or reimbursed for low-income taxpayers who are below the federal poverty level. Long-term payment plan without direct debit Long-term payment plan with direct ...

A Guide to Paying Quarterly Taxes - TurboTax Tax Tips & Videos The self-employment tax (Social Security and Medicare) Income tax on the profits that your business made and any other income. For example, in the 2021 tax year: The self-employment tax rate on net income up to $142,800 for tax year 2021 is 15.3%. That breaks down to 12.4% Social Security tax and 2.9% Medicare tax.

Payment Instruction Booklet - EFTPS Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 940 940 12 Employer’s Quarterly Federal Tax Return Payment due with a return Payment due on an IRS notice 09405 09401 09404 941 941 03, 06, 09, 12 Employer’s ...

/GettyImages-547460657-576c1a4f3df78cb62c26e2fc.jpg)

Post a Comment for "39 irs quarterly payment coupon"