41 zero coupon bonds definition

Expectations Theory Definition - Investopedia Expectations Theory: The Expectations Theory - also known as the Unbiased Expectations Theory - states that long-term interest rates hold a forecast for short-term interest rates in the future ... JOHNSON & JOHNSONLS-NOTES 2007(07/24) Bond - Insider The Johnson & Johnson-Bond has a maturity date of 11/6/2024 and offers a coupon of 5.5000%. The payment of the coupon will take place 1.0 times per Year on the 06.11..

Bond Option Definition - Investopedia Bond Option: An option contract in which the underlying asset is a bond. Other than the different characteristics of the underlying assets, there is no significant difference between stock and ...

Zero coupon bonds definition

Municipal Bond Fund Definition Municipal bond funds may be managed with various aims which can be usually primarily based on location, credit score high quality, and length. Municipal bonds are debt securities issued by a state, municipality, county, or particular objective district (akin to a public faculty or airport) to finance capital expenditures. Municipal bond funds ... How to Invest in Bonds: A Beginner's Guide to Buying Bonds There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year ... Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred coupon bonds can be Zero-coupon bonds for a specific period of time and then pay a certain interest for the remaining period till maturity. For example, a deferred coupon bond with 4 years as a deferred period with a coupon of 6% will not pay any interest for the first four years from the issuance date.

Zero coupon bonds definition. Plain Vanilla Bonds - Meaning, Features, Example, & Advantages There are many coupon features that can come in a bond. A bond can be a zero-coupon bond, in which there is no coupon payment, or it can be a step-up bond, in which the coupon rate increase after a predetermined period of time, and there are also floating-rate bonds whose coupon rate keeps changing every few months. Such is not the case with ... Pricing risk-based disaster bonds for earthquakes at an city scale - 4 ... Lastly, the pricing of zero-coupon and coupon CAT bonds is carried out by combining the outcomes of the rate of interest mannequin, mixture loss mannequin and the payoff perform. Mathematically, the worth of zero-coupon ((V_{zc})) and coupon-type ((V_{c})) CAT bonds at a given time t, assuming a risk-neutralized pricing measure Q, is given by 5: Bond ETF Definition Bond ETFs provide lots of the similar options of a person bond, together with a common coupon cost. One of essentially the most vital advantages of proudly owning bonds is the prospect to obtain fastened funds on a daily schedule. These funds historically occur each six months. steamboatcoupons Amazon UK Coupon, Promo Codes: 30% Off - June 2022 Amazon UK Coupon, Promo Codes: 30% Off - June 2022 Amazon UK Coupons & Promo Codes Submit a Coupon Save with 44 Amazon UK Offers. 30% OFF Code 30% Off SEAMANTIKAs Dark Circle And Bags Added by guysalexpress960837 1 use today Show Coupon Code See Details UP TO 30% OFF Sale Up to 30% Off Women's ...

EGP T-Bonds Zero Coupon Historical EGP T-Bonds. EGP T-Bonds Zero Coupon. Deposits (OMO) Fixed Rate Deposits. Variable Rate Deposits. Corridor Linked Deposits. Repo. Fixed Rate Repo. Variable Rate Repo. Long Term Government Bond ETF List - ETF Database Long Term Government Bond ETF List. Long Term Government Bond ETFs provide investors with exposure to the long side of the U.S. bond market. These funds focus on debt sponsored by the U.S. government or its agencies and can include Treasuries, MBS, TIPS or other debt. Long-term bonds generally have maturities longer than 10 years. Netherlands Government Bonds - Yields Curve The Netherlands 10Y Government Bond has a 1.830% yield.. 10 Years vs 2 Years bond spread is 82.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.00% (last modification in March 2016).. The Netherlands credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 10.70 and implied probability of default is 0.18%. Issue Descriptor - Negotiated Trade Reporting - NSE India About Negotiated Trade Reporting Platform. Products & Services. Issue Descriptor. Trading. Settlement. Non Competitive Bidding in G-Sec. Request for Quote. Traded on CM. Tri Party Repo.

Zero-point energy - Wikipedia Zero-point energy (ZPE) is the lowest possible energy that a quantum mechanical system may have. Unlike in classical mechanics, quantum systems constantly fluctuate in their lowest energy state as described by the Heisenberg uncertainty principle. Therefore, even at absolute zero, atoms and molecules retain some vibrational motion.Apart from atoms and molecules, the empty space of the vacuum ... Pricing risk-based catastrophe bonds for earthquakes at an urban scale ... In case of zero-coupon bond (see Fig. 6a), we observe that the price of bond decreases with increasing time to maturity. At a given maturity T , the bond price increases with increasing threshold ... United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.448% yield.. 10 Years vs 2 Years bond spread is 2.3 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 16.70 and implied probability of default is 0 ... CashStock - Eevrything about IPOs, Personal Finance and Stocks Zero Coupon Bond Definition, Meaning and Example. Terminologies | Zero Based Budgeting Definition - Example and Importance. Uncategorized | Do you know you can refuse paying service charge at Restaurants? Uncategorized | Government of India has clarified that the service charge is optional. If the customers are not happy with the service ...

Zero Coupon 2025 Fund | American Century Investments Each Zero-Coupon fund invests in different maturities of these debt securities and has different interest rate risks. The fund can only offer a relatively predictable return if held to maturity (2025). Investment in zero coupon securities is subject to greater price risk than interest-paying securities of similar maturity.

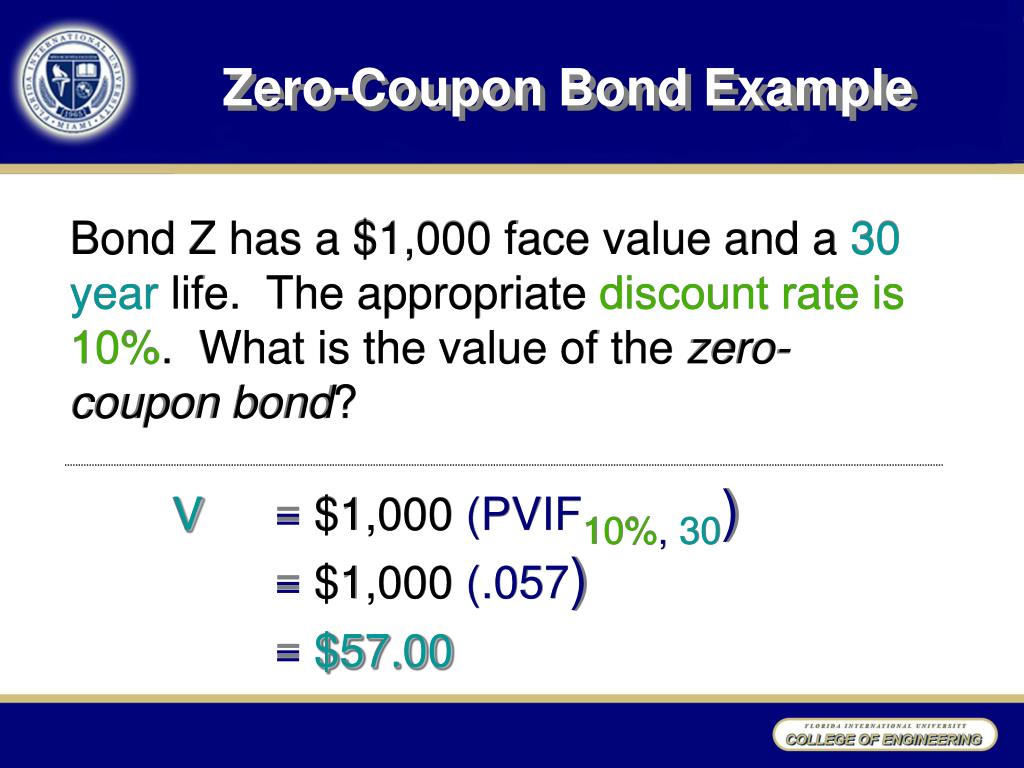

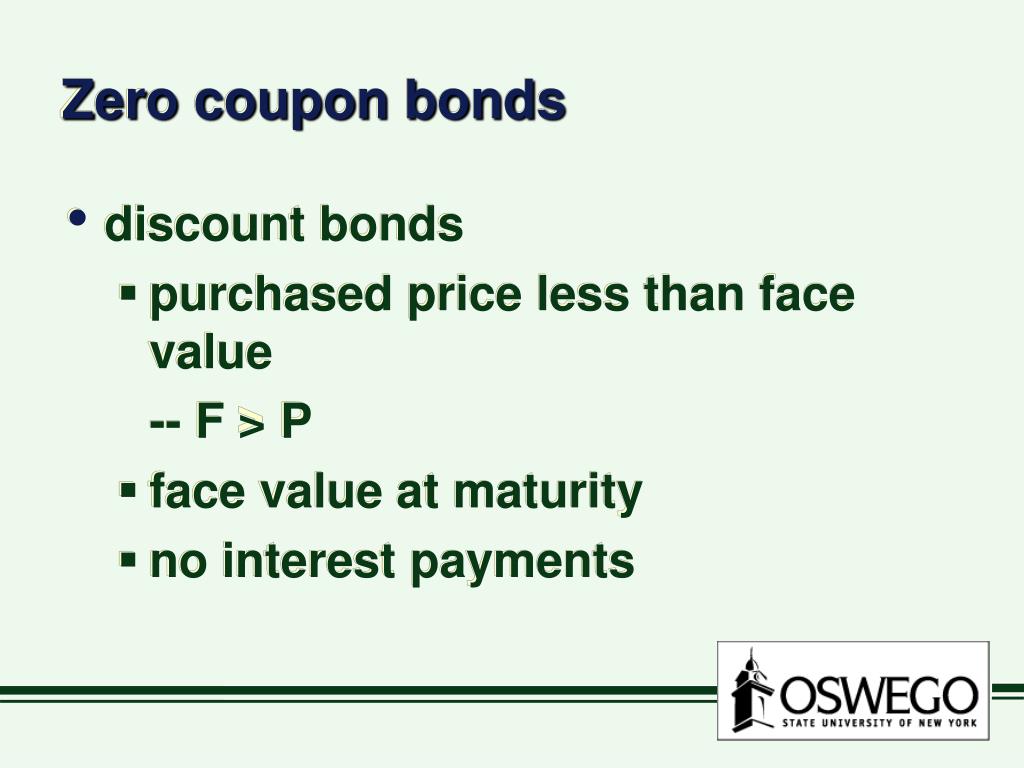

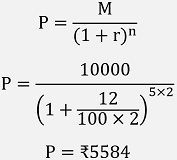

What Are Corporate Bonds? | Nasdaq Zero-Coupon Bonds Some bonds, called zero-coupon bonds, do not pay interest during the term of the bond. They are purchased for prices below par, then the par value is paid when the bond matures.

Bullhead Citys Coupon What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead ...

Should You Buy Treasury Bonds? - EC Cafe Treasury bills and bonds pay interest every six months. They can be auctioned at a discount, a par, or even a premium depending on the terms of the bond (yield to maturity and interest rate). When treasury bills are traded in the secondary market, prices depend on prevailing interest rates, rate expectations, coupon (interest) payments, etc.

UPDATE - SolarEdge to sell zero-coupon bonds in USD-550m offering September 24 (Renewables Now) - Israel-based photovoltaic (PV) inverters supplier SolarEdge Technologies Inc (NASDAQ:SEDG) has decided that the 2025 bonds to be offered in an upcoming USD-550-million (EUR 471.8m) deal will bear no coupon. The company will launch a private placement on September 25, it said on Wednesday, adding that the proceeds ...

US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 18 hours ago, on 14 Jun 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

WHAT IS FACE VALUE? What is It's Significance? Interest rates (as compared to the bond's coupon rate) can impact whether a bond sells at or below par in the bond market. Zero-coupon bonds, or those in which investors receive no interest other than the cost of purchasing the bond below face value, are typically sold below par because it is the only option for an investor to profit.

Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred coupon bonds can be Zero-coupon bonds for a specific period of time and then pay a certain interest for the remaining period till maturity. For example, a deferred coupon bond with 4 years as a deferred period with a coupon of 6% will not pay any interest for the first four years from the issuance date.

How to Invest in Bonds: A Beginner's Guide to Buying Bonds There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year ...

Municipal Bond Fund Definition Municipal bond funds may be managed with various aims which can be usually primarily based on location, credit score high quality, and length. Municipal bonds are debt securities issued by a state, municipality, county, or particular objective district (akin to a public faculty or airport) to finance capital expenditures. Municipal bond funds ...

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/3d85d69309ce00a0aec81515720c6c18/thumb_1200_1697.png)

Post a Comment for "41 zero coupon bonds definition"